bexar county tax office pay online

For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers. The Online Portal is also available to agents that have been authorized to represent an owner under section 1111 of the Texas Property Tax Code.

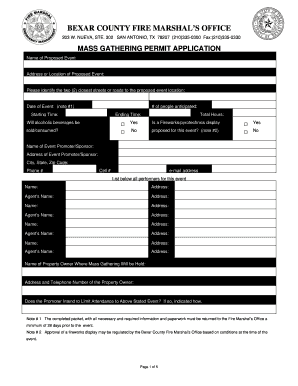

Bexar County Fire Marshal Office Form Fill Out And Sign Printable Pdf Template Signnow

Bexar County Tax Assessor-Collector Office P.

. San Antonio TX 78205. Tax Bills Who to Contact for Tax Bills. T he Bexar Appraisal District highly.

Clicking on the link. You can search for any account whose property taxes are collected by the Bexar County Tax Office. Commissioners Court Broadcast Agendas.

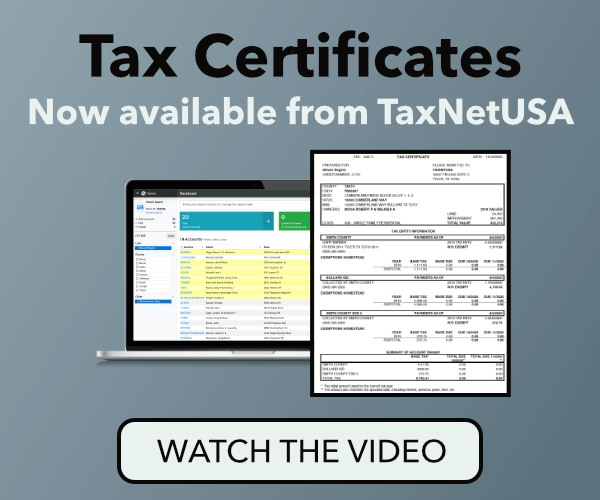

Pay your Bexar County Property taxes online using this service. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. Find Your Property Tax Account.

Please contact the Bexar County Clerks Office at 210 335-2221 or visit. For questions regarding tax amounts visit the County Tax Office Website email or call 210 335-2251. Your property tax burden is decided by your locally elected officials and all inquiries concerning your local taxes should be directed to those officials Property Search Data last.

Tax Rate In Houston HOUSTON CN Two Texas Republicans prevented their Democratic. Each portfolio may consist of one or more properties and includes pertinent tax. Box 839950 San Antonio TX 78283-3950.

Please allow up to 15 days for the processing of your new window sticker or new plates by. The address for the Tax Office is. To pay your property taxes in San Antonio you can go to the Bexar County Tax Office website and pay online by mail or in person.

Enter an account number owners name last. You can search for any account whose property taxes are collected by the Bexar County Tax Office. Please follow the instructions below.

411 North Frio Street San. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. After locating the account you can pay online by.

10 in favor of a proposal to raise the countys property tax rate by 8. As a property owner your most. Pay your Bexar County Property taxes online using this service.

Thank you for visiting the Bexar County ePayment Network. Please select the type of payment you are interested in making from the options below. Bexar Appraisal District is responsible for appraising all real.

You can create a portfolio if you want to group multiple tax accounts together for easier review and payment.

Bexar County Tax Assessor Collector Albert Uresti Bexar County Tx Official Website

Bexar County Tax Assessor Collector Albert Uresti Bexar County Tx Official Website

Property Appraisal Protests Set Record For Bexar County In 2022

Bexar County Tax Assessor Collector Weights In On Outside Breach Woai

Bexar County Tx Official Website Official Website

Bexar County Once Again Selling Homes Delinquent On Their Taxes

Cash Strapped Property Owners In Bexar County Face June 30 Tax Deadline

Bexar Appraisal District Facebook

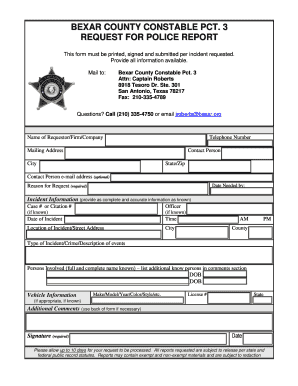

Fillable Online Bexar County Constable Pct Fax Email Print Pdffiller

Bexar County Precinct 1 Justice Of The Peace Court In San Antonio

Bexar County 2021 Property Tax Payment Due Monday Kabb

Bexar County Covid 19 Response Bexar County Tx Official Website

Bexar County Tx Property Search Interactive Gis Map

Bexar County Offers Aid To Delinquent Property Taxpayers Community Impact

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill

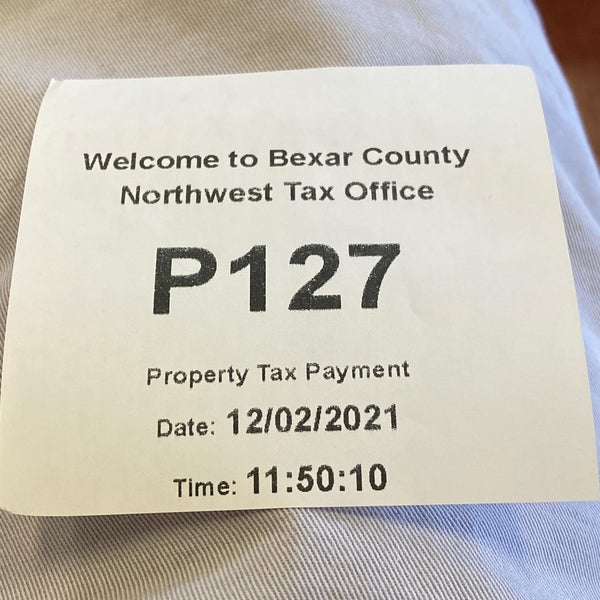

Albert Uresti Bexar County Tax Assessor Collector Building In Northwest Side

Guadalupe County Tax Office Home

Bexar County Tax Assessor Collector 12 Reviews 233 N Pecos La Trinidad San Antonio Tx Yelp